PrimeMover Blog

Welcome to IBT PrimeMOVER Blog

PrimeMOVER utilizes IBT’s knowledgeable industry professionals to educate our readers on top industry solutions.

How Automation Can Protect Your Bearings

Bearings are unsung heroes, quite literally bearing the weight of relentless motion in industrial systems. They play a critical role in transferring loads, reducing friction

Plastic or Steel? How to Choose the Right Conveyor Bucket

Conveyor buckets stand out as an exceptionally versatile choice for all kinds of material handling. However, that wide applicability means there are also important choices

What Is a Grease Gun Used For?

From industrial facilities and farms to manufacturers, warehouses, and countless other industries, heavy machinery forms the backbone of daily operations. These machines are constantly moving,

Solutions to the Most Common Sprocket Problems

Sprockets are essential components of many industrial systems. Sometimes known as sprocket wheels, sprockets rotate while engaging with a belt or chain. Notches in the

The Many Uses of Multipurpose Industrial Hose

You might think you could use multipurpose hose for just about anything. And you’d be right! While there are applications that multipurpose industrial hose is

Understanding Pneumatics: How It Works, Industrial Applications, & Pneumatic vs. Hydraulic Systems

In the world of industrial automation and manufacturing, pneumatic systems play a crucial role in powering various applications. Pneumatic systems utilize compressed air to transmit

4 Common Types of Industrial Automation Tools

Industrial automation tools have ushered in a new era of efficiency, precision, and innovation across a wide range of industries. These tools enable automated technologies

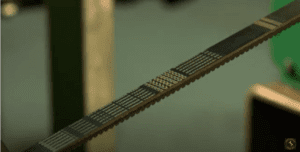

Using a Belt Tension Gauge: The Ultimate Guide

In the world of industrial machinery and equipment, efficiency and reliability are paramount. One crucial aspect of ensuring the smooth operation of various machines, from

4 Ways to Get the Most Out of Your Conveyor Systems

When you look at the world around you, most everything you see has at one point been on a conveyor system. But for it to

What to Expect During an Industrial Bearing Installation

Bearings are an essential component for many pieces of machinery and equipment. When it comes to the service life of bearings, the brand and model

5 Types of Industrial Equipment Used in the Grain/Agriculture Industry

Technology has made leaps and bounds over the last several decades, increasing our understanding of plants and how to increase yield. But even as our

What is Pick & Place Robotics?

Are you looking to take your warehouse or manufacturing facility to the next level with improved automation? With the advancement in robotics and industrial automation,

Downtime Anxiety? Read These Tips to Get The Most From Your Couplings.

In the dynamic landscape of industrial solutions, choosing the right coupling is crucial for seamless operations, cost-effectiveness, and enhanced efficiency. Lovejoy, renowned for its innovative

Selecting Optimal Conveyor Belts for Efficiency and Safety in the Aggregate Industry

In the bustling world of aggregate handling, where efficiency and safety are paramount, conveyor belts play a crucial role, silently ensuring the seamless flow of

Industrial Material Handling & Lifting Equipment: A Comprehensive Guide

In today’s fast-paced industrial landscape, efficient material handling and lifting equipment play a crucial role in optimizing productivity and ensuring workplace safety. For this reason,

Elevating Industry Standards: Deep Groove Ball Bearings and the Power of Schaeffler’s FAG Generation C

Deep groove ball bearings play a crucial role in various industrial applications by quietly facilitating the smooth rotation of machinery. These unassuming components play a

What’s the Difference Between Brushed and Brushless Motors?

Electric motors power critical machinery and equipment in industrial, manufacturing, and commercial facilities. Conveyer belts, pumps, fans, blowers, power tools, and more are all powered

Choosing the Right Roller Bearings: A Comprehensive Guide

Roller bearings may not be the most glamorous components in machinery, but they play a crucial role in keeping various industries moving smoothly. Whether you’re

Unlocking Efficiency: The Core Components of Conveyor Belt Systems

In the world of conveyor belt systems, there are numerous options and configurations, each designed to efficiently transport materials from one point to another. In

A Step-by-Step Guide on How to Install a V-Belt

In the intricate world of industrial machinery, where precision and reliability hold the utmost importance, the V-belt plays a crucial role. Proper V-belt installation can

Exploring the Advantages of Torque-Arm Speed Reducers and the Latest Evolution of TXT from Dodge® Industrial

In industrial operations, optimizing efficiency is paramount. Ensuring seamless mechanical power transmission is essential for equipment to operate at peak performance. Speed reducers play a

What Are the Most Common Types of Hydraulic Hose Fittings?

Hydraulic fittings are found across nearly every industry, with a wide variety of uses and applications. Different types of fittings are designed for different applications

How to Properly Remove and Replace an Industrial Bearing

Industrial bearings are critical in smoothly operating industrial machinery, equipment, and motors. Over time, these bearings can be damaged or wear out due to normal

Enhancing Operational Reliability: The Role of Climax Two-Piece Couplings in Preventing Line Shaft Failures

Operational reliability stands as a critical pillar within the industrial landscape. The smooth operation of machinery isn’t merely an efficiency concern – it’s the bedrock

Extending Industrial Bearing Life with SKF: The Crucial Role of Power Transmission Reliability

In the world of industrial machinery, the longevity of industrial bearings plays a pivotal role in ensuring smooth operations and peak performance. Industrial bearings, often

6 Signs and Symptoms of Electric Motor Failure

Electric motors play a crucial role in any industrial facility. Electric motors power machinery and equipment, such as conveyor belts, pumps, fans, blowers, compressors, power

A Helpful Guide to Drag Chain Conveyors: How They Work and Their Key Applications

Drag chain conveyors are essential components of material handling systems, enabling the efficient and reliable transportation of bulk materials. In this comprehensive guide, we will

Maximizing Equipment Reliability: Preventing Bearing Failure with NTN’s SPAW Series

In the world of industrial equipment and machinery, bearings play a crucial role in supporting rotating components and ensuring smooth operation. The reliability of these

Palletizing vs. Depalletizing: What’s the Difference?

Every business dealing in physical products and materials has space dedicated for shipping and receiving goods. Once goods reach a large enough volume, they are

Choosing Automatic Lubrication for Your Yellow Iron Equipment

Tired of manually lubricating your yellow iron equipment? IBT Industrial Solutions has the perfect way to save you time and money. For your convenience, we

6 Essential Maintenance Tips for Extending the Lifespan of Industrial Conveyor Belts

Industrial conveyor belts play a crucial role in bulk material handling, ensuring the smooth movement of materials and products. To maximize their lifespan and maintain

A Guide to 5 Crucial Types of Bearings for Optimal Performance

In the world of engineering, the significance of bearings cannot be overstated. These small yet mighty components play a crucial role in various applications, ensuring

Get in touch for help and information

Our head office address:

9400 W 55th St, Merriam, KS 66203

Call for help:

(913) 428-2858